All of our school families are asked to review and complete the student income form. This information is very important to ensure our continued participation in the Federal programs. These programs provide a variety of materials and services for the children, teachers, and our school. It is one of the few benefits our children receive from your tax dollars and we do not want to lose it. After reading the information below, please click here to complete the form by Thursday, October 7.

Questions? Please contact Principal Veronica Gaier at v.gaier@lehmancatholic. com or by calling 937.498.1161

Why should you complete the student income form if your child does not eat school meals?

In order to receive money for e-rate, technology, and connectivity this form must be completed by each family. The income levels do affect other federal programs from which our school benefits.

For eligible elementary schools, the amount of federal funds your school building receives is dependent on the return of this completed form. These funds, known as Title I, pay for additional educational services for students who are failing or at risk of failing to meet the same high standards as everyone else in the school. Our district provides additional tutoring in reading and mathematics. Title I requires that funds be given to schools based on the number of children from low-income families.

While the amount of money each school receives depends on the number of children from low-income families, the tutoring services are based on the academic need of the students regardless of income level.

What happens if you fill out this form?

- Your name will not be given out to anyone except your district.

- Your school building may be able to get more money.

- That money may be used:

- to hire teachers

- to buy materials

- for technology

- for connectivity

United States Department of Agriculture (USDA)

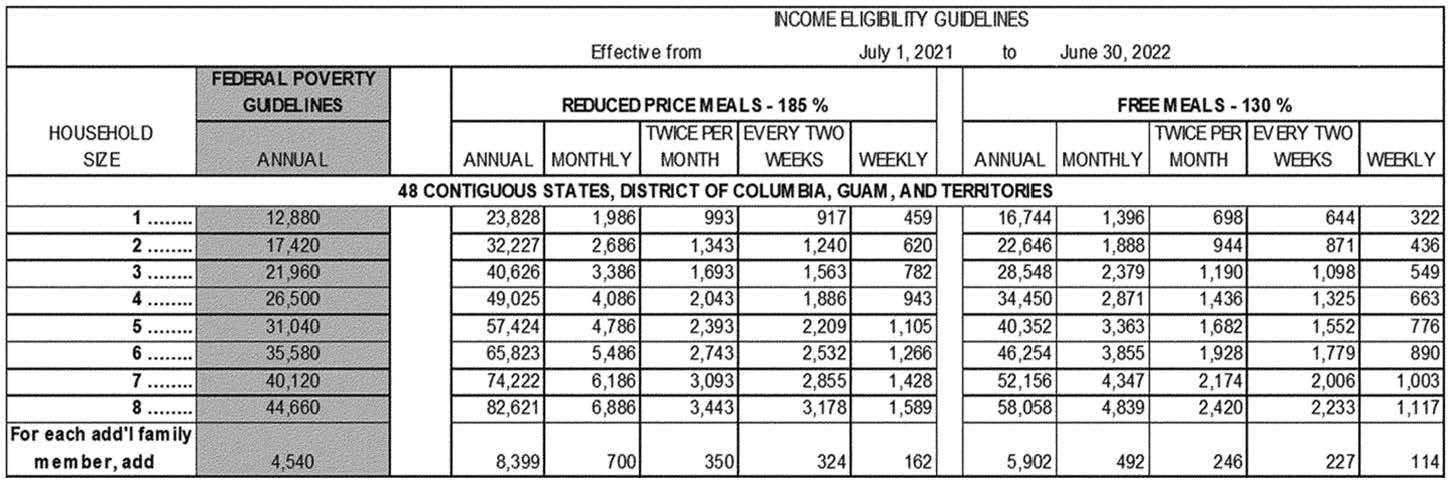

INCOME ELIGIBILITY GUIDELINES

effective July 1, 2021, through June 30, 2022

Households with total incomes less than or equal to the values below are eligible for free or reduced-price meals. Please review the chart below to determine if your family is eligible for free or reduced-price meals.

INCOME CONVERSION:

Weekly Income x 52 = Annual income

Every 2 Weeks Income (every other week, bi-weekly) x 26 = Annual income

Twice a Month Income (bi-weekly) x 24 = Annual income

Calculating Household Income: In order to determine if the school your child attends will receive Title I funds, you will have to calculate the total amount of income in your household. Include all income for all household members (include yourself, all children in the home, your spouse, grandparents, and all others related and unrelated members in your household). See the list below of the types of income to report.

Earnings from Work

Wages/Salaries/tips

Strike benefits

Unemployment compensation

Worker’s compensation

Net income from self-owned business or farm

Pensions/Retirement/Social Security

Pensions

Supplemental security income

Social Security

Retirement income

Public Assistance/Child Support/Alimony

Public assistance (welfare) payments

Alimony/child support payments

Other Income

Disability benefits

Cash withdrawal from savings

Interest dividends

Income from estates/trusts/investments

Regular contributions from a person not living in the household

Net royalties/annuities/net rental income

Any other income

Please click here to complete the form by Thursday, October 7.

Questions? Please contact Principal Veronica Gaier at v.gaier@lehmancatholic. com or by calling 937.498.1161